PRESS RELEASES

Explore the latest announcements, updates and more from CNA.

CNA Hardy’s 2019 Global Risk & Confidence Survey published today finds that as global, interconnected risk becomes a reality, reputational risk is rising and business confidence is on the slide.

London, 30 May 2019: CNA Hardy’s 2019 Global Risk & Confidence Survey published today finds that as global, interconnected risk becomes a reality, reputational risk is rising and business confidence is on the slide.

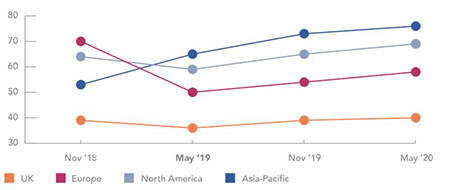

Research for the latest edition of the report highlights a clear East-West divide in terms of confidence. While optimism has fallen among executives leading European, UK and North American businesses, it continues to rise in Asia Pacific.

Ongoing discussions regarding how the UK is to exit Europe are having a markedly negative impact on business confidence on both sides of the Channel. In the UK only 36% of leaders are confident in the ability of their firm to grow and prosper – a far cry from May ’17 when 71% of business leaders were confident. In Europe only 50% are confident - a fall of almost one third in the past six months. In North America, confidence fell back 8% to 59% over the past six months as here too improving economic fundamentals continued to take a battering from economic and policy shocks.

Asia Pacific is the only region where confidence has risen (up 23% to 65%) in the past six months, and where executives globally believe there is the greatest capacity to drive growth.

All change in global business confidence

Percentage of business leaders that are confident in the ability of their business to grow and prosper

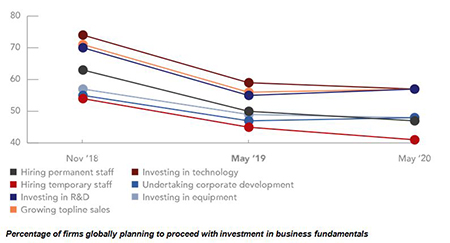

Investment in business fundamentals on the slide

Against this backdrop, the rate of investment in business fundamentals has fallen dramatically in the six months to May ’19, with investment in talent and research & development (R&D) among the hardest hit areas. Dave Brosnan comments: “Uncertainty is a key driver of high levels of caution about investment in business fundamentals. Companies are simply not prepared to put capital at risk in an environment where unpredictability reigns. The inevitable, but extremely damaging consequence is that fewer companies are maintaining investment in technology, R&D and talent to support the top line.”

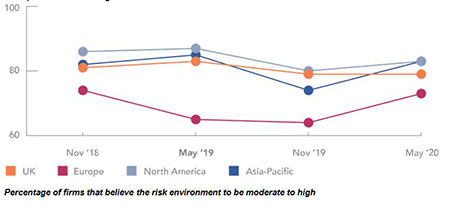

The reality of global interconnected risk hits home

Underpinning changes in business confidence is companies’ constant reassessment of the shifting risk environment. Globally, the percentage of business leaders who feel they operate in a moderate to high risk environment held broadly steady at 81%, with European business leaders the least risk averse (65%) and North American the most (87%).

Dave Brosnan comments: “The data shows a strong consensus among global business leaders on the direction of travel in terms of risk overall. This alignment of risk perceptions over time and across the regions demonstrates very clearly the reality of interconnected risk. From connected devices and international supply chains, to the global financial system, the potential for small problems to trigger unexpected cascading failures, is now all around us.”

Globally, economic risk is the biggest concern both now and in 12 months’ time, followed by cyber then tech risk. Economic risk – though remaining the most mentioned risk overall - is set to decline as political and reputational risk gain momentum.

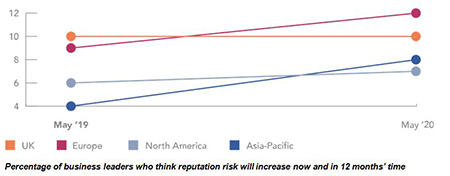

Reputation risk rising fast

As business leaders look ahead to May ‘20, we see that reputation risk is growing faster than any other – up 29% globally, a third (33%) in Europe and doubling in Asia Pacific between May ‘19 and May ‘20.

Dave Brosnan, CEO, CNA Hardy said:

“In an increasingly complex, tech-led, interconnected global economy, business leaders are being tested like never before. The result is that confidence has dipped, investment in business fundamentals is down across the board and reputation risk has emerged as the new threat that stalks the corridors of power.”

Businesses are divided on how to manage reputation risk

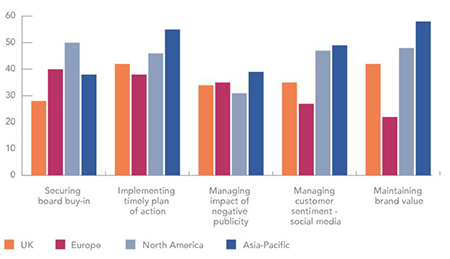

Businesses we spoke to were divided regarding the most significant challenges they face when dealing with brand or reputation risk. Managing the logistical challenges – securing board buy-in and implementing a timely plan of action – were two of the highest ranked priorities. But maintaining brand value was narrowly the top concern globally, with sentiment particularly marked in Asia Pacific and North America.

Strong appetite for innovative insurance response

CNA Hardy is finding significant appetite among its broker network and insureds for deeper discussion and insight around the drivers of boardroom risk and strategies for risk prevention and mitigation.

Dave Brosnan, CEO, CNA Hardy said: “Reputation cover will become mainstream as boardroom risk is re-evaluated. In the same way the market has found a way to model the cost of non-physical damage business interruption claims as part of terror and political violence cover, we believe there is scope to model and mitigate the cost of managing reputation risk and the consequential damage to brand value caused by specific triggers.”

REGIONAL DATA

North America: cautious but hopeful

Kathleen Ellis, Senior Vice President, CNA International Solutions comments: “Managing supply chain complexity is relevant and a growing issue of importance, even for mid-size businesses. Although large firms have more at stake, smaller and mid-sized firms still must efficiently manage how and where they produce, assemble and distribute product. Due to the smaller or mid-size scale, they are vulnerable if they ‘guess’ wrong on shifting global politics and policy. These and other factors, such as natural catastrophe, contribute to this cautionary mood.

Nick Creatura, President and CEO, CNA Canada comments: “Management liability risk is also rising. This is partly attributable to the increasing pervasiveness of social media. The need to be the ‘first to know’ drives a heightened sense of urgency to report on events, but that reporting is often overly aggressive and misinformed. The market reacts very quickly – and it never likes surprises. So companies take significant hits in reputation and market value when they experience negative events. The manner in which these situations are handled is extremely important in mitigating the impact of such events.”

Asia-Pacific: the tiger roars again

Carl Day, Vice President, Property, Marine & Energy, CNA Hardy, comments: “The growth in confidence in Asia-Pacific is great news for corporates in this part of the world and marks a significant shift in sentiment from just six months ago. As President Xi’s signature Belt & Road initiative rebuilds the region’s ancient silk routes with nearly a US$ 1 trillion earmarked for infrastructure investments to around 1000 projects, domestic and foreign enterprises alike will want to ensure that their supply chains are optimised to capitalise on the Asian growth story.”

Brexit batters confidence in UK and Europe

“It is inevitable that the combination of political and economic volatility with regulatory uncertainty will drive reputational risk,” said Carl Day, Vice President, Property, Marine and Energy CNA Hardy. “Business leaders are at a point where forecasting is problematic, investment in business fundamentals is going on hold, and the risk of strategic missteps is rising. Interconnected risk is a feature of modern business life, and here we see it played out through the lens of a shifting UK-Europe relationship.”

Contacts

Europe & Asia: Georgina Peters-Venzano I +442076454968 / +447739448121 – georgina.peters-venzano@cnahardy.com

USA: Allyson Marcus: 001 2679949052 - Allyson.marcus@kemperlesnik.com

Canada: Lynn Lafortune I 001 4165427399 – lynn.lafortune@cna.com

About CNA Hardy

CNA Hardy, acting in the UK through Hardy (Underwriting Agencies) Limited and CNA Insurance Company Limited, and in Europe through CNA Insurance Company (Europe) S.A., is a leading specialist commercial insurance provider for clients within both the Lloyd’s and company markets. For more information, please visit CNA Hardy at http://www.cnahardy.com/.

CNA is one of the largest U.S. commercial property and casualty insurance companies. CNA provides a broad range of standard and specialized property and casualty insurance products and services for businesses and professionals in the U.S., Canada and Europe, backed by 120 years of experience and approximately $45 billion of assets. For more information, please visit CNA at http://www.cna.com/.

Follow CNA Hardy on: LinkedIn | Twitter

Follow CNA on: Facebook | Twitter | LinkedIn | YouTube

CNA Insurance Company Limited (company registration number 950) and Hardy (Underwriting Agencies) Limited (company registration number 1264271) are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (firm reference number 202777 and 204843 respectively). CNA Services (UK) Limited (registered number 8836589). ‘CNAHardy’ is a trading name of CNA Insurance Company Limited and Hardy Underwriting Group PLC (which includes Hardy (Underwriting Agencies) Limited and Hardy Underwriting Asia PTE). VAT registration number 667557779.

The above companies are all registered in England with their registered office at 20 Fenchurch Street, London, EC3M 3BY.

Switchboard: +44 (0)20 7743 6800 Facsimile: +44 (0)20 7743 6801